canadian tax strategies for high income earners

A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. A Solo 401k for your business delivers major opportunities for huge tax.

RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax.

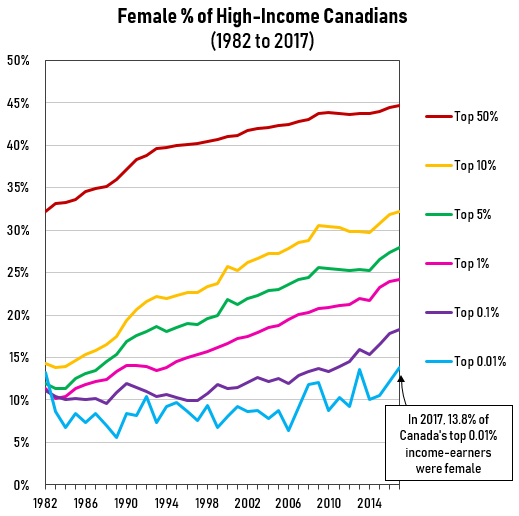

. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year. Invest in Tax-Free Savings Accounts TFSA Among the best tax strategies for high income earners is to benefit from the fact that any contributions made to tax-free savings. Tax minimization strategies for individuals Income splitting with family members.

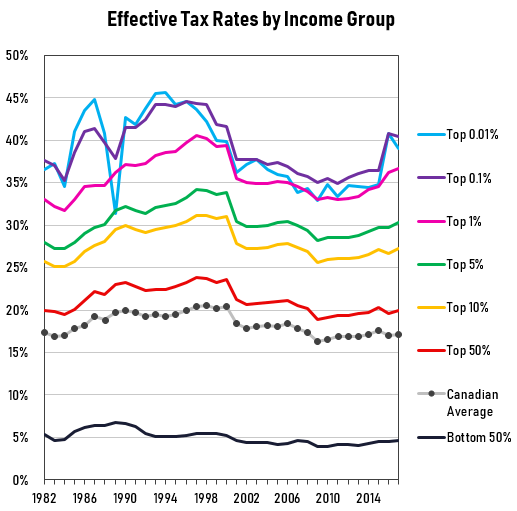

We will begin by looking at the tax laws applicable to high-income earners. If properly structured family trusts or partnerships can help you move your. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts.

AG Tax professionals have prepared a list of certain tax. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax.

For high income earners Please contact us for more information about the topics discussed in this article. When personal income exceeds 200000 in. Canadian Tax Loopholes.

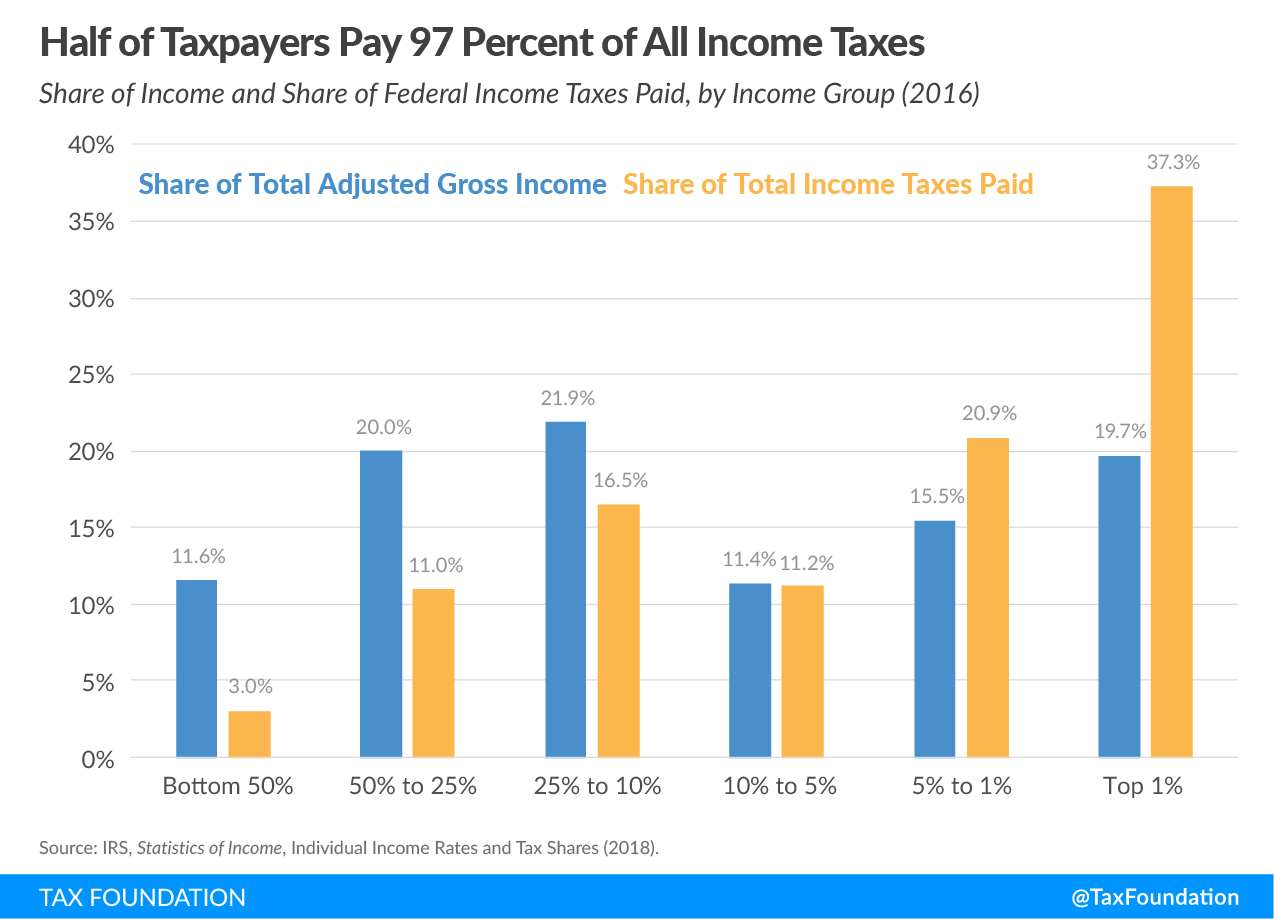

Tax Strategies for High-Income Earners Consider using above-the-line deductions to help reduce your adjustable gross income AGI. Lets start with an overview of tax rules. Registered Retirement Savings Plans RRSPs Registered Education Savings Plans.

Its never too early to start tax planning for the New Year. 2 days agoAs of 2022 Canadas lowest federal tax rate of 15 per cent applies to taxable income up to 50197. For higher-income earners income splitting redirecting income within a family unit can be.

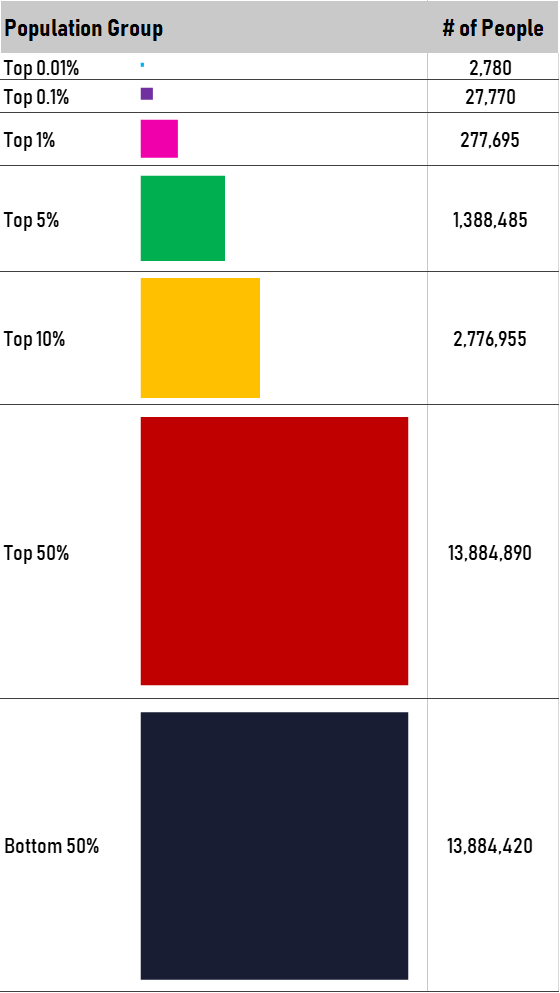

Income splitting and trusts This is one of the most important tax strategies for you as a high-income earner. High-income earners make 170050 per year in gross income or 340100 if married or filing. Done properly tax planning has the potential to minimize tax obligations.

Its possible that you could.

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Advanced Tax Strategies For High Net Worth Individuals Bnn Bloomberg

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

How To Reduce Taxes For High Income Earners In Canada

Tax Strategies For High Income Earners 2022 Youtube

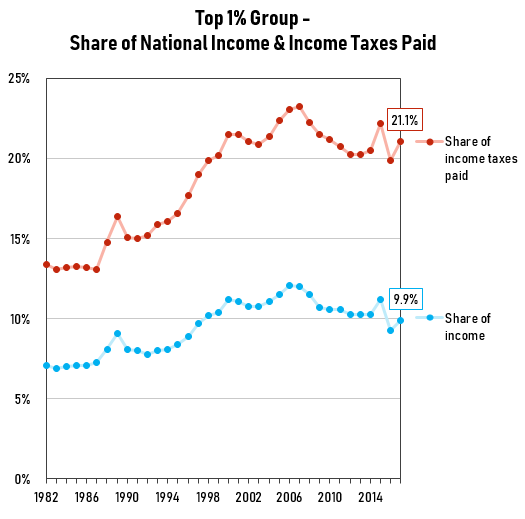

Millionaires And High Income Earners Tax Foundation

How The Tax Burden Has Changed Since 1960

Proposed Tax Changes For High Income Individuals Ey Us

Personal Income Tax Brackets Ontario 2021 Md Tax

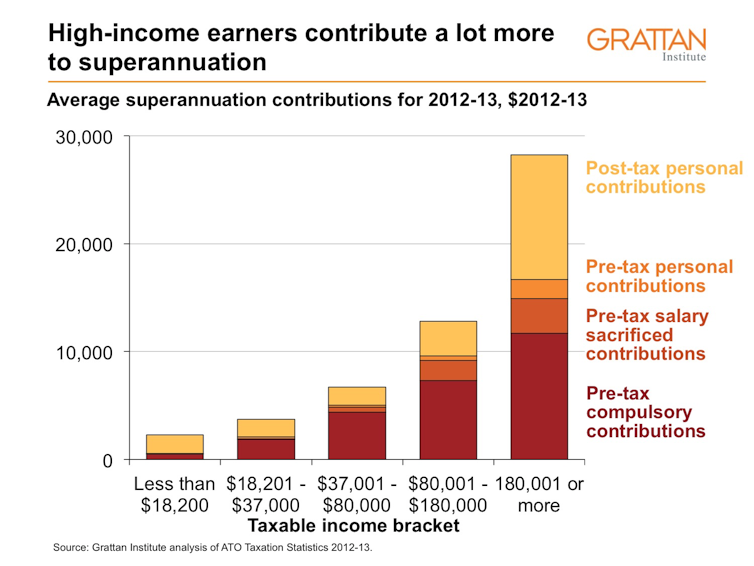

Catch Up Super Contributions A Tax Break For Rich Old Men

High Income Earners Need Specialized Advice Investment Executive